What Are 5 Things That the Most Successful Podcasts Have in Common?

The number of available podcasts has exploded in recent times. That means your podcast has to stand out from the crowd. With millions of episodes available and thousands more being created every day, what separates the truly successful shows from the rest?

One of the fundamentals of having a successful following is professional production values. If you search Poddster Studio Singapore, for instance, you can see how that part of the formula can be achieved.

In addition to using a professional studio, there are also several other key elements that successful podcasts tend to share.

Here are five critical factors commonly found among the most successful podcasts:

Consistent and High-Quality Content

The backbone of any successful podcast is high-quality content delivered consistently. Successful podcasters understand their audience’s interests and curate their content accordingly.

They diligently invest time in researching topics, scripting, and post-production editing to ensure each episode provides value and is engaging. On top of that, maintaining a regular posting schedule builds listener anticipation and trust, essential for retaining and growing an audience.

A good podcaster also understands that regularity doesn’t necessarily mean frequently. What matters more is reliability in the content’s timing and quality.

A Strong, Engaging Host is Always Important

Charismatic hosts with a knack for storytelling can significantly influence a podcast’s success. They are usually knowledgeable and passionate about the podcast’s subject matter. The ability to communicate in an engaging and relatable way is also of paramount importance.

The personality of the host often becomes a brand in itself, attracting listeners who feel a personal connection to the presenter. This connection can encourage listeners to return episode after episode, creating a loyal fanbase in the process.

Professional Sound Quality

Good audio quality is non-negotiable. No matter how compelling the content, poor sound quality can deter listeners from getting into the podcast. Successful podcasts need access to good recording equipment and editing software. Many savvy podcasters are savvy enough to realize that hiring professionals to ensure the sound is clear, crisp, and pleasant to listen to is a no-brainer.

Effective Engagement Strategies

Successful podcasts don’t just speak to an audience, they engage with them. This can include social media interactions, listener polls, Q&A sessions, and incorporating listener feedback into episodes.

Many successful podcasters also build communities around their podcasts, creating spaces for listeners to discuss episodes, share ideas, and connect with each other.

These strategies enhance the listeners’ experience and foster a sense of community and loyalty.

Clear Niche Focus

While some successful podcasts cover a broad range of topics, most zero in on a specific niche. This ensures they appeal directly to the interests of a targeted audience.

This specialization allows podcasters to become authorities in their chosen subjects. A clearly defined niche helps in attracting a dedicated segment of listeners who are passionate about the topic and seeking detailed and expert information.

Creating a successful podcast requires dedication, skill, and a genuine connection with your audience. By combining all of these highlighted elements you have the ingredients required for creating a valuable and enjoyable listening experience that keeps audiences coming back for more.

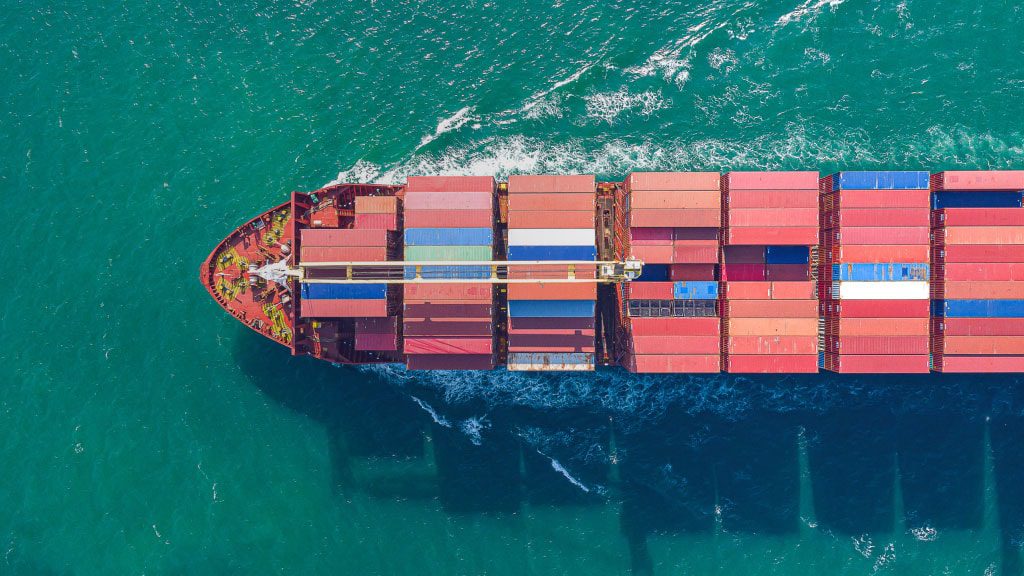

What is FCL Shipping (Full Container Load)

What is FCL Shipping (Full Container Load)