How explainer videos plays important role in your startup business strategy

In today’s scenario, videos are gaining ample popularity not just due to its excellent benefits, but also due to its affordability and effectiveness. Indeed, videos are helping businesses to hit their goals. Video marketing allows marketers to grab the visitor’s attention in a very short span of time.

By creating alluring and informative explainer videos, one can easily express almost everything and make people familiar with your business offers. Yes! With 90-sec video, you can easily add value to your business marketing and make your brand globally recognized.

Still not satisfied? You are at the right place. Through this article, I will take you through various reasons that will help you understand why 90% of the businesses are using explainer videos to complete their desired actions and achieve their business goals.

How explainer videos can help startup businesses to gain success

Let’s get started…

Generate more traffic

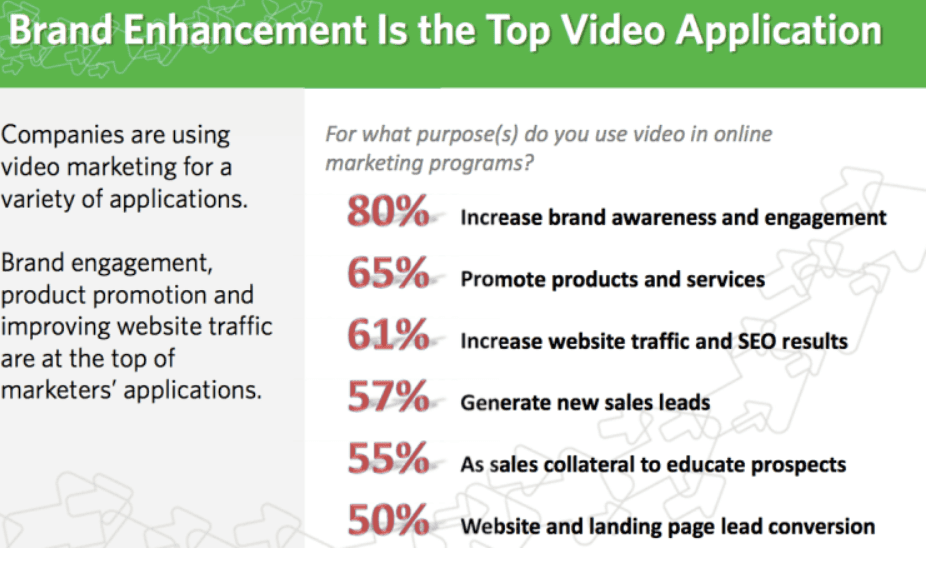

When we talk about startup business, then going viral is one thing that can help them improve their business productivity. And to increase web traffic, videos play a great role. A viral video will help you gain popularity and allow visitors to know how the organization can help them achieve their goals.

According to the analysis, 82% of internet traffic comes from attractive videos. If your videos are good, you can easily double your organic search traffic. Remember, the more the traffic, the higher the conversions. So, if you want to see fantastic results in your startup marketing strategy, then don’t forget to add videos in your plan.

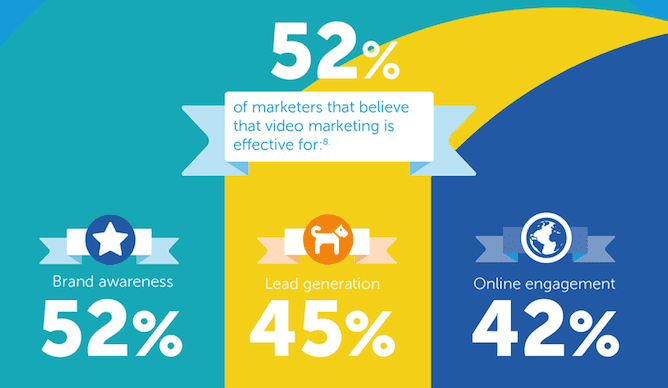

Another reason why organizations are using explainer videos is to increase their visibility on the web. Increasing brand awareness is another step that can help you increase your customer base and sales. And to achieve such desires, videos help a lot!

Uploading videos on the right platform will help you raise the awareness of your brand and allow you to make the right decision at the right time. According to HubSpot, 85% of the customers always prefer watching videos from the brands.

So, if you want to streamline your startup business strategy and increase the number of sales without putting much effort and time, then start creating short and creative explainer videos.

Source: walkaroundvideos

Prefer reading- 5 Ways to incorporate an explainer video to your marketing strategy

Highly affordable and effective

No matter whether it’s a startup or a huge organization, every organization wants to generate a positive impact on their business without breaking the banks. Well! That’s where videos come into play.

The best part about the explainer video is that you don’t have to invest huge money. There are various softwares and video production companies that allow individuals to produce videos faster that are both clearer, enjoyable and affordable. So, start leveraging the power explainer video to measure the success of your business without breaking your banks.

Earn a better ROI

Videos also play a vital role when it comes to long term investment and ROI. If you are spending money on creating videos, then you can expect a huge return. Around 51% of marketers consider videos as one of the best types of content that generate huge ROI.

According to the research, 85% of the people are likely to make a purchase after watching explainer videos. So, if you want to hype up your business sales and increase conversions to generate better ROI, then start investing in videos, as video marketing has huge scope in improving the opportunities and staying competitive.

Makes the explanation easy

For a startup, explaining the product or service is not a cakewalk. But yes! With explainer videos, it is something that is possible. If you have explainer videos on your landing pages, you can explain complex products/services easily.

According to the statistics, 97% of the organizations believe that with the help of explainer videos, it becomes really easy to make people understand the concept/products/services easily. Always remember, more will be the understanding of the concept, the easier it becomes to engage the visitors and convert them into leads.

Around 69% of the people get to know about the product or services by watching effective videos. Thus, to make people better understand the concept, start using video in the best possible way. Whenever you create a video, make sure it has a proper story.

Encourage social shares

Have you ever realized whether social sharing can help you enhance your productivity? Yes! The organizations that are focusing on their social media, such as Facebook, Twitter, Youtube, etc. are able to analyze their sales and increase their productivity. And to increase the number of social shares, videos can help a lot.

According to the statistics, the organizations that are creating social videos are able to generate 1200 times more shares as compared to long formatted content and images. Always remember, the higher the number of shares, the more the revenue.

So, if you want to see better results for your startup business, then upload entertaining and effective videos on your social media and see a positive impact on your ROI.

Source: position2

Rank Better in Google Search

Almost every business wants to appear in the top searches of Google. Because if your website is ranking at the top, then the chances to attract more visitors and convert them into quality leads increase. To increase the website ranking, you can add videos in your marketing strategy.

According to the analysis, the organizations that are creating videos are 53 times more likely to show up at the top of Google. Yes! Videos can act as a core element for your marketing strategy. But, whenever you produce videos, always have your target audience in mind. It will definitely allow you to see fantastic results in a short span of time.

In a Nutshell

There are no two opinions that videos are both economic and effective parts of digital marketing. It helps both startups and huge organizations in capturing leads and escalating their business growth. Having an engaging and educational video not only helps in promoting business but also allows in building strong customer relations.

So, if you want to create real miracles and take your startup business at the next step, make the best use of explainer videos. But still, if you have any query, or want to add something in the above list, feel free to share your opinions in the comment section added below.