The Strategy Driven Guide to Financial Investments

Stabilize Your Own Budget

Creating a personal budget is the first step everyone needs to take. You cannot invest money, after all, when you don’t have anything left over at the end of the month. To stabilize your budget so that you can have money to invest, you will need to:

Go Through Your Spending Habits

By understanding where your money goes, you can work out what your actual monthly budget is. Your rent and other fixed costs are unavoidable, so cut them out from what you receive in income and work on minimizing your costs so you can comfortably live with your exact monthly budget and not your monthly income.

Minimize Your Life

The best way to reduce costs is to minimize your life. From de-cluttering to being more mindful with your shopping habits, there are so many ways to reduce your lifestyle. This doesn’t mean you need to give up what you love, but only that you give up what you don’t care about.

Save Up for Emergencies

There are so many unexpected costs that can come your way and put you and your family from comfortable to in debt before you know it. From car repairs to boiler replacements, to even hospital bills. These costs do happen, and having an emergency fund that will cover them without you needing to take out a loan will be a huge relief.

Invest in Your Future

To invest in your future, you will need to do so much more with your money than keeping some of it in an emergency savings fund. You will want to:

1. Invest in Real Estate

Owning your own home gives you a lot of options in the future, especially if you get onto the property ladder in your early twenties. When it comes time to retire, you can then sell it and downsize, or you can rent out your property and enjoy a monthly income.

2. Invest into Your Retirement

If you don’t currently have a strong retirement plan in place, go to the bank or look online today to set one up. Sure, you might think you are safe with your 401(k) plan, but the fact of the matter is you need to do so much more to secure your future. That is why having a LIRP is such a good idea because it allows you to save for your retirement, gives your family the peace of mind that life insurance provides, and of course improves your retirement’s outlook.

With just a little bit of foresight and strategic planning, you can turn your modest income into a huge savings account in the future. Follow this guide as soon as you can, and you will have a future waiting for you to enjoy.

Ah, the joy of youth. Carefree and without worry – until we pursue our first real job. Then the anxiety about our age rears its ugly head for the first time. “Will clients have trouble responding to me because of my age? Will co-workers think my age makes me less qualified for the position I hold? If only I were a little older…” Although it seems hard to fathom, these sentiments were quite real when we were beginning our work lives.

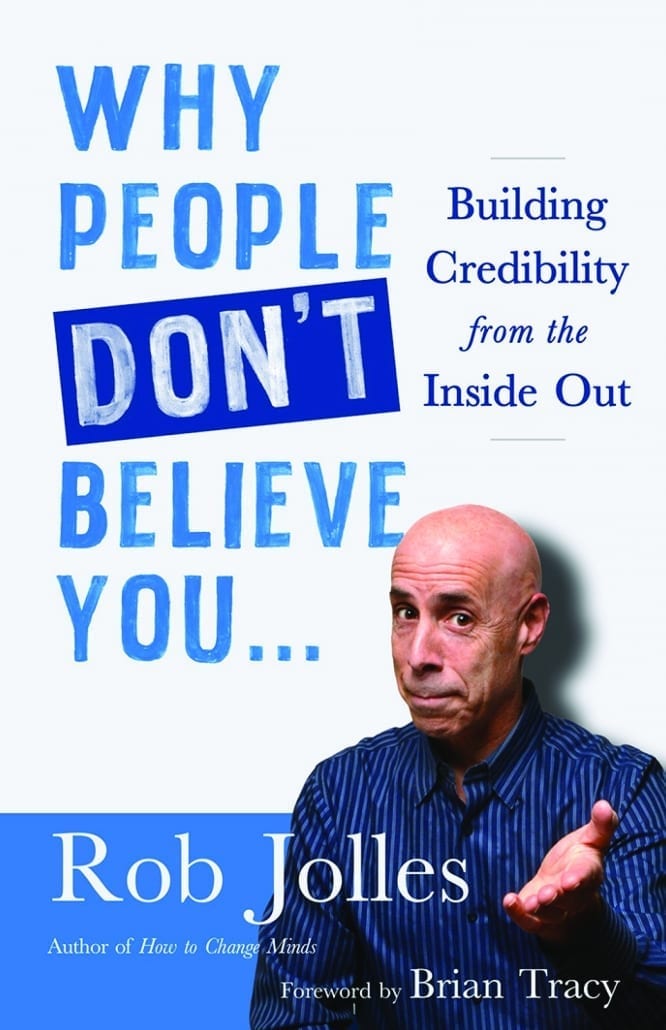

Ah, the joy of youth. Carefree and without worry – until we pursue our first real job. Then the anxiety about our age rears its ugly head for the first time. “Will clients have trouble responding to me because of my age? Will co-workers think my age makes me less qualified for the position I hold? If only I were a little older…” Although it seems hard to fathom, these sentiments were quite real when we were beginning our work lives. Rob Jolles is a sought-after speaker who teaches, entertains, and inspires audiences worldwide. His live programs in and around the world have enabled him to amass a client list of Fortune 500 companies including Toyota, Disney, GE, a dozen universities, and over 50 financial institutions. He is the best-selling author of six books, including his latest release, Why People Don’t Believe You… Building Credibility from the Inside Out. To learn more, visit

Rob Jolles is a sought-after speaker who teaches, entertains, and inspires audiences worldwide. His live programs in and around the world have enabled him to amass a client list of Fortune 500 companies including Toyota, Disney, GE, a dozen universities, and over 50 financial institutions. He is the best-selling author of six books, including his latest release, Why People Don’t Believe You… Building Credibility from the Inside Out. To learn more, visit  Negotiation is an art form. It requires interpersonal skills, a masterful control of language, a deep understanding of human emotion, and excellent listening skills. This is perhaps why a small company’s success often hinges on the quality of its salespeople.

Negotiation is an art form. It requires interpersonal skills, a masterful control of language, a deep understanding of human emotion, and excellent listening skills. This is perhaps why a small company’s success often hinges on the quality of its salespeople.

In order to succeed and thrive in modern society, all private and public sector entities must live by codes of ethics. In an era that encompasses mistrust of business, uncertainties about the economy and growing disillusionments within society’s structure, it is vital for every organization to determine, analyze, fine-tune and communicate their value systems.

In order to succeed and thrive in modern society, all private and public sector entities must live by codes of ethics. In an era that encompasses mistrust of business, uncertainties about the economy and growing disillusionments within society’s structure, it is vital for every organization to determine, analyze, fine-tune and communicate their value systems. Power Stars to Light the Business Flame, by Hank Moore, encompasses a full-scope business perspective, invaluable for the corporate and small business markets. It is a compendium book, containing quotes and extrapolations into business culture, arranged in 76 business categories.

Power Stars to Light the Business Flame, by Hank Moore, encompasses a full-scope business perspective, invaluable for the corporate and small business markets. It is a compendium book, containing quotes and extrapolations into business culture, arranged in 76 business categories.