The Significance of Data Optimization During Covid-19 Pandemic

The simple fact is that businesses need to be able to build trusted relationships with their customers beyond the physical spaces represented by storefronts and square footage. As ironic as that sounds, what distinguishes data is its human factor. Interpreting and making decisions based on data during a time when competitors are trying to capture the attention of their consumers is vital.

Today, amid a global pandemic and subsequent overhaul of how businesses access and interface with their customers, we find ourselves suddenly competing on a level playing field that is the attention of a phone, computer, or TV. No foot traffic, no event, launch, or experience — just time and attention on a screen, and it’s the ones who have optimized their data who are winning.

Here are a few tentpoles to consider points of entry towards optimizing your data:

The Customer

The modern customer has high expectations and demands that enterprises strive to achieve — at all costs. A business with quality data optimization services has comprehensive information that is customer-centered, dynamic, and always available.

As a result, there is a real-time ability to address all customer demands without going through a complicated, costly, or time-consuming process. Naturally, as customers become more aggressive in having their requirements met, your business stays a step ahead of competitors, when it comes to availing quick and accurate solutions. The most critical aspect of better data management is the reduction of inefficiencies in operations that cost businesses as much as 25% of their revenue. This is because enterprises with better control over their data reduce the potential of making mistakes. As a result, their trustworthiness among customers in any niche industry grows, and they become seen as market leaders.

Direct Sources

Long gone are the days when e-commerce strategy meant focusing only on SEO. Mike Ewing, a Customer Success Strategy & Operations Manager, writes on Hubspot, ”if you rely on free/direct sources of traffic, you are fighting shared losses. Direct has gone from 75% to 9% over the last ten years, while e-commerce has been growing 15-25%.”

Today, you need to find a way to seamlessly integrate direct traffic, transaction data, demographic data, paid search, comparison shopping engines, marketplaces, mobile, and social media. That’s a lot! Each medium comes with its own tools, database, and strategies — only by combining all can your business stay on top of your competition… and crush your topline goals and quotas.

Bottom line: Your products and services should be where your clients are.

Speed

The data modern enterprises depend upon may have many different sources and a variety of structured and unstructured formats. In many cases, the data will contain inaccuracies, inconsistencies, redundant information, or other anomalies that make it unnecessarily difficult to access critical information in a timely and comprehensive fashion.

The data optimization process makes use of sophisticated data quality tools that help to access, organize, and cleanse data — whatever the source — to maximize the speed and comprehensiveness with which pertinent information can be extracted, analyzed, and put to use. That enhanced availability of critical information provides businesses with significant benefits.

Data optimization helps business leaders understand and improve their business processes so that they can reduce the wastage of time and money. Consider the information age, a time and place where consumers expect to get fast, accurate, and comprehensive information from the business they are dealing with.

Embracing Data

Amid the panic and unrest of a rapidly changing COVID-19 environment, business leaders in the trenches must lean in to leverage all tools to make themselves more digitally enabled… if for no other reason than to maintain their relationship with their customers during times when human contact is not an option.

We must all consider new ways to bring the human factor into decisions around data optimization. The time is now.

About the Author

Megan Silva is a data optimization leader and advocate. Over the course of her 15-year career in data, Megan has led numerous business and process improvement initiatives, with an emphasis and focus on increased capabilities and decreased costs. She is best known for her leadership on measurable and scalable results, defining customer journeys, aligning content for automated campaigns, and improving contact and data strategy. Megan holds a Master of Industrial Labor Relations from Cornell University and a Bachelor of Science from the University of Wisconsin-Madison.

Data is the new currency and often the point of strategic control in many industries. Companies are attempting to control data in order to monetize what the data can do for them. Take this example from windmill technology as an illustration:

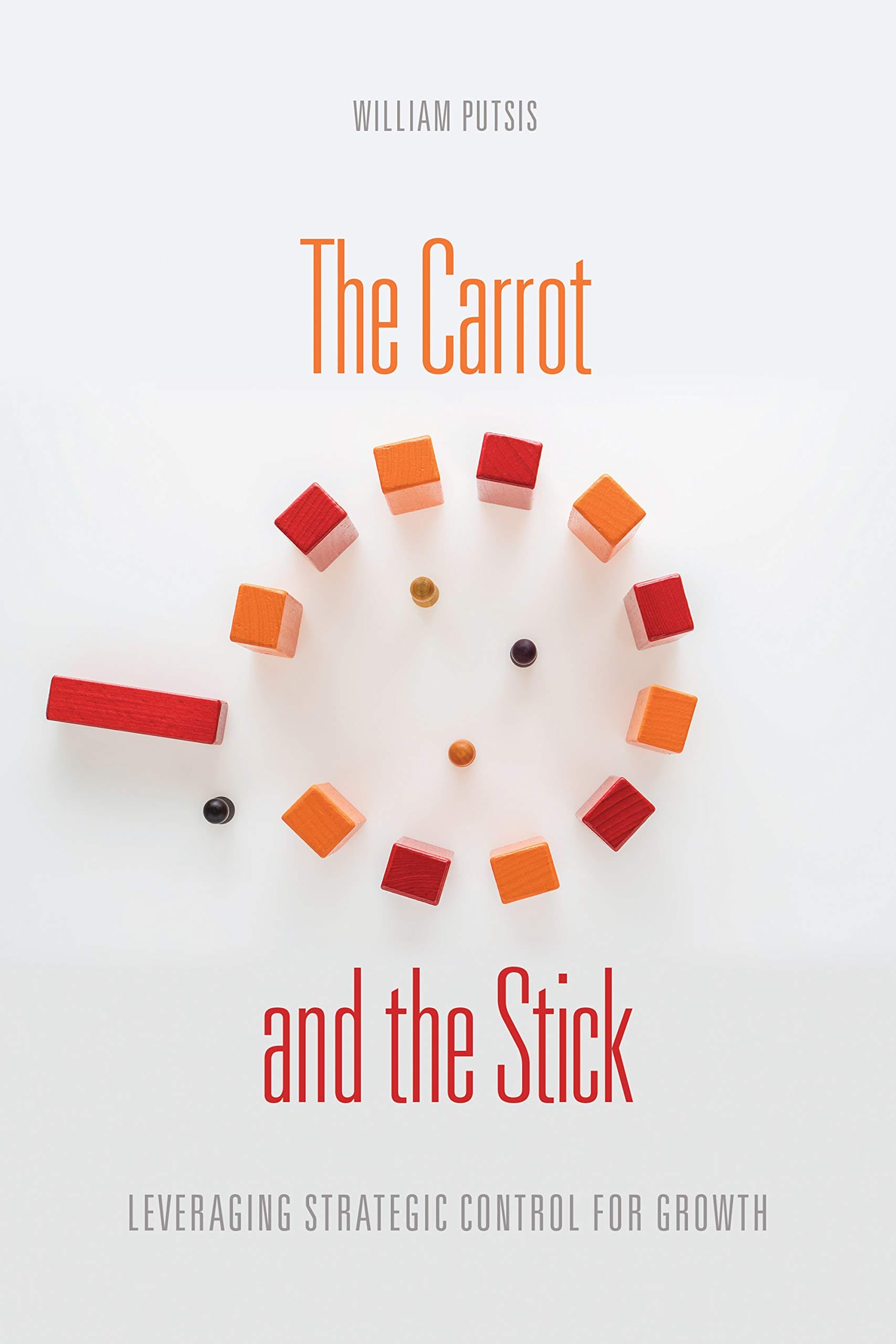

Data is the new currency and often the point of strategic control in many industries. Companies are attempting to control data in order to monetize what the data can do for them. Take this example from windmill technology as an illustration: Dr. William Putsis is a Professor of Marketing, Economics and Business Strategy at the University of North Carolina-Chapel Hill, and a Faculty Fellow for Executive Programs at Yale University. He is also president and CEO of Chestnut Hill Associates, a strategy consulting firm, and founder of the software company, CADEO Economics, which automates his data modeling-based strategy development processes. His new book is

Dr. William Putsis is a Professor of Marketing, Economics and Business Strategy at the University of North Carolina-Chapel Hill, and a Faculty Fellow for Executive Programs at Yale University. He is also president and CEO of Chestnut Hill Associates, a strategy consulting firm, and founder of the software company, CADEO Economics, which automates his data modeling-based strategy development processes. His new book is