8 Tips for a Smooth Auditing Process

After you file your small or midsize business’s taxes for the year, you think you’re done with taxes. However, sometimes you’re contacted about the process that most business owners dread: an audit. While being audited is a long process that takes extra time, by following these eight tips, you ease your worries and help the process go more smoothly.

After you file your small or midsize business’s taxes for the year, you think you’re done with taxes. However, sometimes you’re contacted about the process that most business owners dread: an audit. While being audited is a long process that takes extra time, by following these eight tips, you ease your worries and help the process go more smoothly.

1. Don’t Panic

If you’ve filed your taxes honestly, you don’t have anything to fear from auditing services. Most auditors look for blatant fraud such as inaccurately reporting your gross income. They also examine your accounting procedures and make sure that they’re sufficient for your business’s size. For example, if you don’t have an accounting department and your business is growing, they may recommend that you hire a full-time employee to oversee your finances. Remember, all you have to do is cooperate with the auditors’ questions, so take a deep breath and get ready for your audit.

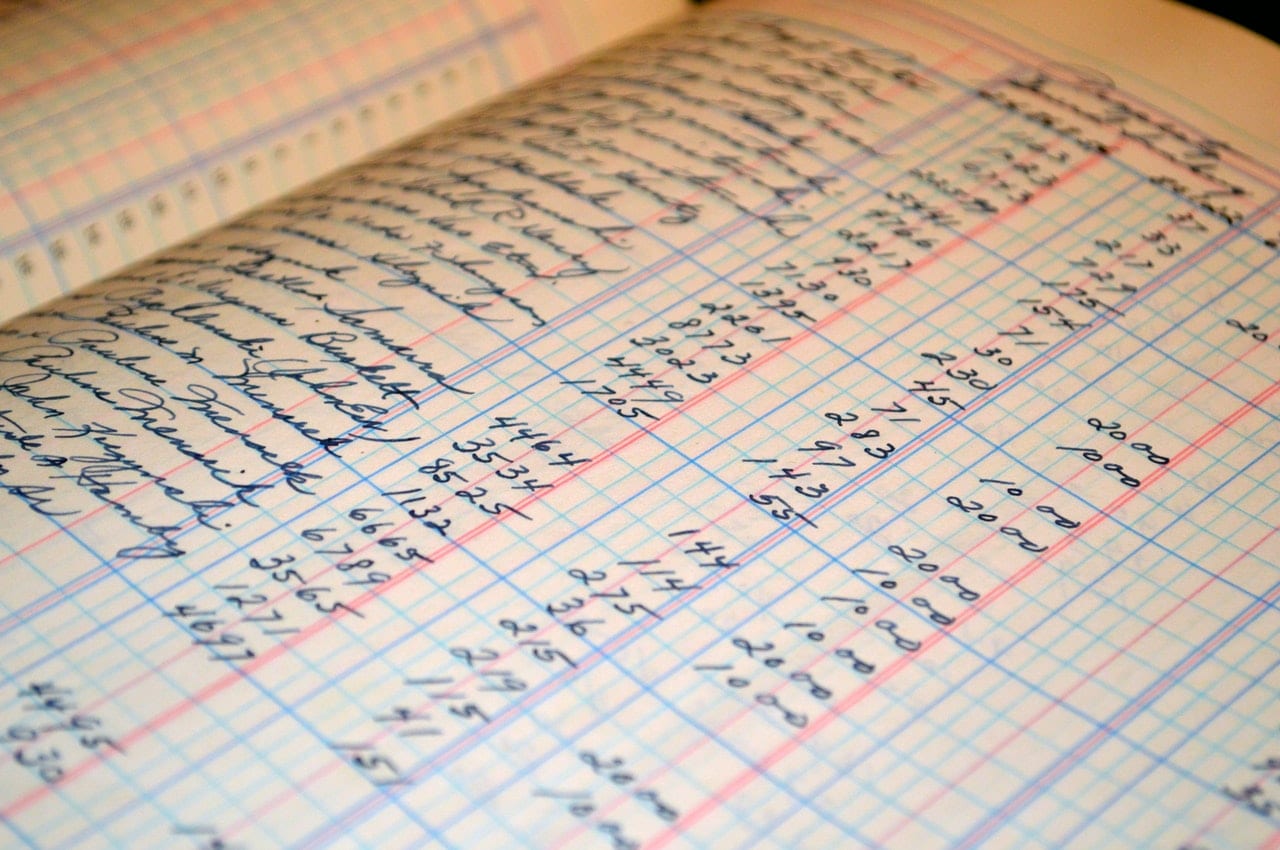

2. Keep Your Records

Audits are usually ordered within seven months of when you originally filed your taxes, but the Internal Revenue Service can audit your reports from up to two years ago. For example, if you’re audited in July 2021, the audit could be for your 2020 or 2019 taxes. As a result, it’s critical that you hold on to all your tax forms:

- Form 1040

- Form 1065

- Form 1120

Don’t forget to retain your employees’ tax information as well and the forms verifying their ability to work. Keep all these forms organized by year, even after you’ve filed your taxes, so that you’re ready when it’s time for an audit and assurance.

If you’re overwhelmed by all the paperwork, it’s time to find a new organizational system. Scan your paperwork and store it in well-labeled online folders that you can access from any computer. To streamline this process, use a service such as DocuSign rather than printing your forms.

3. Plan Ahead

Scrambling to prepare for an audit makes you look unprofessional and increases the probability that you’ll make a sloppy error. As soon as you find out that you’re being audited, start working with your accounting team to get the forms ready and make sure your books are up-to-date. Leave room in your schedule to take off work during the audit so that you can answer the auditors’ questions. Finally, choose one of your accountants to serve as the primary contact for your auditing team.

4. Think About Your Changes

Has your small business undergone any major changes that affect your accounting procedures in the relevant tax year? For example, did the tax laws change for your industry, or did you upgrade your personal reporting requirements? Consider whether the leadership of your office changed or was restructured, and note any grants or loans you received. By telling your auditors about these factors before the audit begins, you help them understand potential discrepancies in your books.

5. Learn About Tax Laws

Tax laws change frequently, but they don’t always affect your business. It’s critical that you follow all the developments in financial legislation so you’re ready to implement a change. You don’t want to discover during an audit that you’re required to keep your records a certain way. If you’re struggling to understand the laws on your own, reach out to a lawyer, a certified public accountant, or a professional from the Financial Accounting Standards Board.

6. Look Back

If you’ve been audited before, now is a good time to review that auditing report. Did you fix the issues that the previous auditors pointed out, or are you still making them? What parts of your books were confusing or misleading from their perspective? Looking at your auditing report also gives you an idea of how long the process will take and how much you need to be involved.

7. Speak Up

When an auditor asks you a question and you’re not sure what he or she means, don’t be afraid to speak up. Ask follow-up questions and request clarifications; otherwise, you can’t give your auditing team the correct information. If your auditors ask for a record and you don’t think it’s relevant, explain why you don’t think it’s necessary and ask for their perspective.

8. Read the Report

When the auditing process is over, read through the finished report and decide what changes you need to make. Where did you succeed, and where did you fall short of your industry’s requirements? Keep this report close at hand so you can refer to it as you implement changes in your accounting procedures.

No one wants to be audited, but the process is actually beneficial to you. You learn about your accounting mistakes and adjust your practice to align with the law. Just make sure to stay calm, be honest, and keep good records.

Leave a Reply

Want to join the discussion?Feel free to contribute!