12 Common Mistakes to Avoid When Doing NPS Surveys

Net Promoter Score (NPS) is one of the most widely used customer experience (CX) metrics. First developed by Bain & Company in 2003, it was designed to measure customer loyalty and the likelihood of customers recommending a company to others. Its simplicity, ease of use, and the correlation to success have made NPS a favorite among businesses to the point that it’s now typically seen as an industry standard.

However, when NPS surveys are poorly executed, they often fail to generate meaningful insights, leading to misguided decisions. To ensure NPS is used effectively, businesses must avoid these 12 common mistakes, which can undermine the accuracy and impact of their CX strategies.

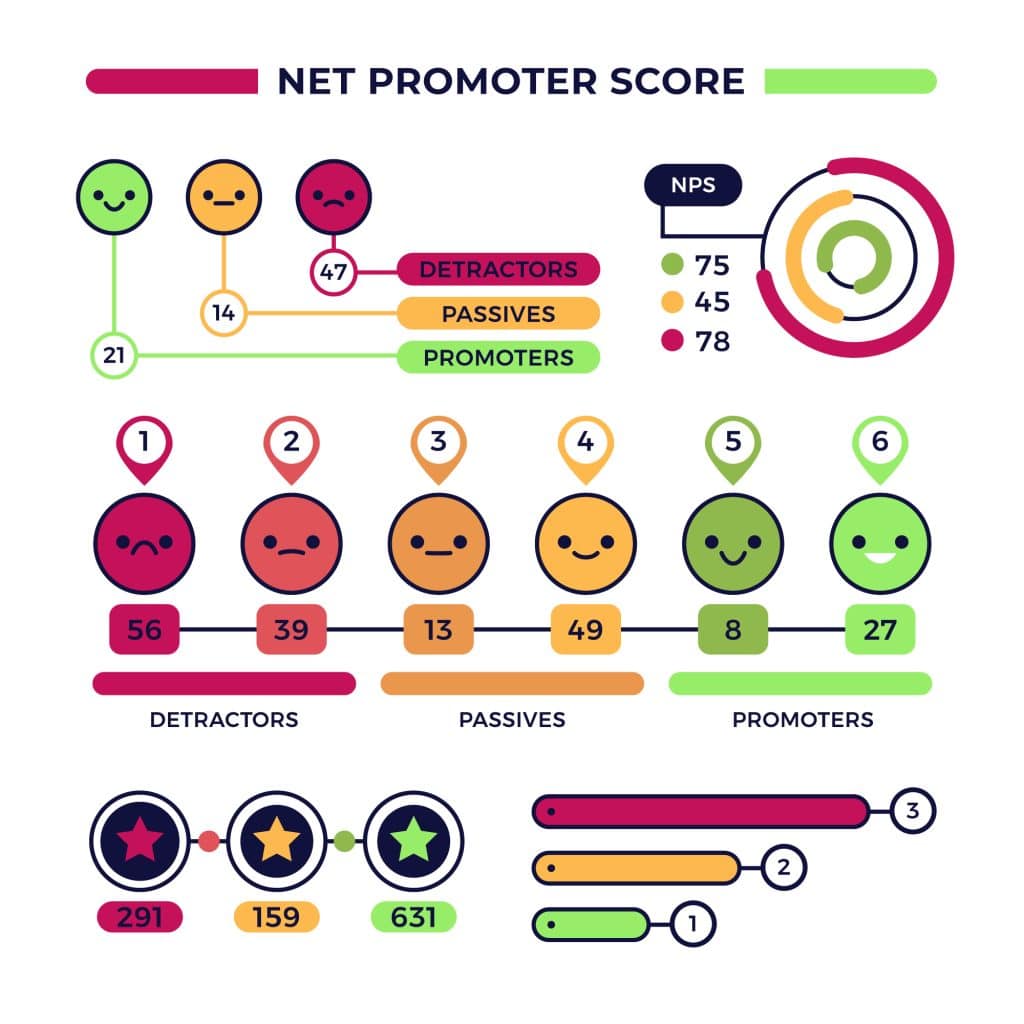

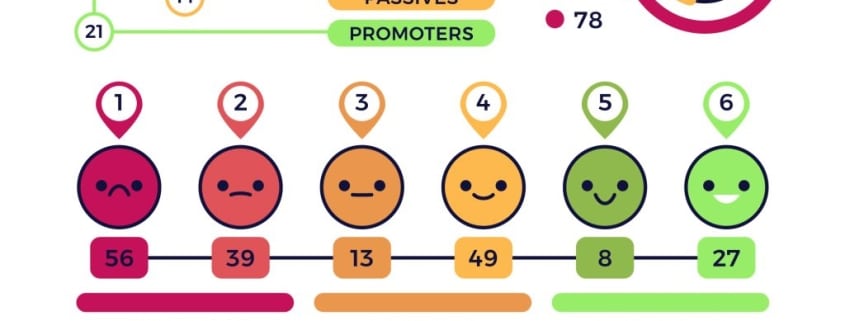

Mistake #1: Not Understanding How NPS Is Calculated

One of the most common mistakes businesses make when using NPS is misinterpreting how it is calculated. NPS is determined by subtracting the percentage of detractors, who are respondents that give a score of 0-6, from the percentage of promoters, who are those that give a score of 9-10. Passives or people who gave scores of 7-8 are excluded from the calculation. Here’s how it looks like:

NPS = [(number of promoters / total number of respondents) – (number of detractors / total number of respondents)] x 100

Some businesses find it unfair that an NPS of 7-8 are not considered Promoters. The reason is because doing so can inflate perceived loyalty and mask weaknesses, as true Promoters (9-10) are enthusiastic advocates who drive growth. Meanwhile, Passives or Neutrals (7-8) are merely satisfied and unlikely to actively recommend the brand.

Lowering the standard risks misleading strategies, and by sticking to the punishing 9-10 threshold, companies avoid complacency and instead focus on converting neutral customers into genuine supporters.

Mistake #2: Using NPS as the Sole CX Metric for Every Touchpoint in the Customer Journey

While NPS is a powerful indicator of customer advocacy, it doesn’t capture the full customer experience. It tells you how likely someone is to recommend your brand—but not how satisfied they are or how easy it was to interact with your business. Relying on NPS alone can leave critical insights on the table.

Different parts of the customer journey call for different metrics. For example, CSAT (Customer Satisfaction Score) is ideal for measuring immediate satisfaction after a support interaction or purchase, while CES (Customer Effort Score) is best suited for evaluating how easy it was for a customer to complete a task—like checking out, resolving an issue, or navigating your site. NPS, on the other hand, is more effective post-purchase or post-engagement, when you’re measuring loyalty and long-term sentiment.

By applying the right metric at the right moment, you gain a more accurate, end-to-end view of the customer journey. A well-rounded CX measurement strategy not only reveals what drives loyalty but also empowers you to make targeted, data-driven improvements.

Mistake # 3: Surveying Too Few Respondents

How many respondents should a survey have? If a company has 200 customers on average, is it enough to get 60 respondents? This is a legitimate question to ask, as a small sample size can lead to fluctuating NPS scores that do not accurately represent customer sentiment. This issue is particularly problematic in B2B settings, where response rates tend to be lower.

To ensure reliability, businesses should collect a significant number of responses across different customer segments. Engaging both promoters and detractors allows for a well-rounded understanding of what’s working and what needs improvement.

Mistake #4: Looking Only at the NPS Score and Failing to Leverage Supplementary Questions

The standard NPS question—”How likely are you to recommend our company to a friend or colleague?”—may not always be enough, especially for B2B customers who are less likely to make referrals due to industry competition. In such cases, the core NPS question can be followed up with open-ended questions and driver questions to understand the “why” behind the score.

To design effective survey questions, it’s important to take into account the background of the target respondent. For instance, a business with long-term contracts might benefit more from asking supplementary questions about overall satisfaction or ease of doing business. Similarly, companies in niche or highly regulated industries may find it more valuable to ask about how well their product meets specific business needs.

This approach ensures that surveys can extract more actionable insights and that the feedback aligns with the business’s unique challenges and goals.

Mistake #5: Ignoring Open-Ended Feedback

Even after asking all the supplementary questions, including the open-ended ones, many businesses still tend to focus solely on their NPS score. By overlooking the qualitative feedback that accompanies their NPS surveys, these businesses miss the valuable insights that often come from understanding why customers give a particular score.

Open-ended feedback helps businesses uncover specific pain points and areas for improvement. Instead of treating NPS as just a number, companies should analyse verbatim responses and look for recurring themes that indicate where action is needed. An AI-assisted Voice of Customer (VoC) solution can be used to analyse the unstructured feedback and collect insights that effectively and smartly distill the collective sentiments of the respondents.

Mistake #6: Conducting Surveys Too Frequently or Too Infrequently

The frequency of NPS surveys matters, particularly to respondents. Over-surveying can lead to survey fatigue and lower response rates, while conducting surveys infrequently can result in a failure to capture real-time sentiment.

To balance this, businesses should blend annual relationship surveys with periodic pulse checks at key customer journey points. For example, a customer experience management platform continuously collects feedback (not just quarterly), so that businesses can track trends over time and reduce the risk of skewed results from timing. This “always-on” method ensures a steady stream of honest feedback, helping businesses spot patterns, address issues proactively, and avoid survey fatigue.

Mistake #7: Comparing NPS Across Different Industries without Context/Benchmarking

NPS scores vary significantly by industry, and comparing them without context can lead to unrealistic expectations. For instance, a score of 50 might be outstanding in a B2B setting but average in a consumer-facing business. Instead of relying on a universal benchmark, companies should assess their NPS relative to competitors in their industry to gain better, more meaningful insights.

Mistake #8: Not Closing the Feedback Loop

One of the biggest missteps is collecting NPS data without making changes based on the insights gathered. If customers see no improvement after providing feedback, they may become disengaged and less likely to participate in future surveys.

To close the feedback loop, businesses should go beyond simply collecting NPS results. They should make it a point to communicate the actions taken in response to the insights from their NPS surveys. Letting customers know how they will help them sort their problem and where applicable how their input has led to tangible improvements builds trust and enhances brand loyalty, plus it encourages them to offer feedback and participate more in surveys.

Mistake #9: Asking for NPS at the Wrong Touchpoints

Timing is crucial when conducting NPS surveys. For instance, asking too early may result in uninformed feedback, while asking too late risks losing relevance. Best practices suggest triggering surveys after key interactions, such as:

- Completing a purchase

- Receiving customer support

- Trying a new feature

It’s also a good idea to look at studies that focus on when people are more likely to respond to surveys. By choosing the right moments, businesses can ensure they capture the most accurate and actionable feedback from respondents.

Mistake #10: Not Segmenting NPS Responses by Customer Type

Treating all customers the same can dilute insights. High-value customers, new users, and long-term clients may have vastly different experiences, and segmenting responses allows businesses to tailor follow-ups accordingly. For example, a new customer’s low NPS score may indicate onboarding challenges, while a long-term customer’s score could reveal declining satisfaction over time. Understanding these distinctions enables more effective improvements.

Mistake #11: Relying Only on Email Surveys

Email surveys remain a common method for collecting NPS responses, but this doesn’t mean businesses can ignore other communication channels that customers prefer to use to submit feedback. To improve customer participation and data accuracy, businesses should diversify their survey channels and complement their email survey forms by using:

- SMS surveys for quick responses

- In-app surveys for digital products

- Bot surveys for e-commerce

Using multiple channels for soliciting responses ensures a more representative sample and enhances the reliability of NPS results.

Mistake #12: Letting NPS Become a Vanity Metric

Some companies treat NPS as a bragging point rather than a tool for improvement. While a high NPS can be a sign of strong customer loyalty, it is meaningless if it does not translate into action. Rather than focusing solely on the number, businesses should use NPS to identify trends, track progress, and refine customer experience strategies. A continuous improvement mindset ensures that NPS remains a valuable and actionable tool.

Maximise the Use of NPS Surveys By Using Them the Right Way

When done right, NPS surveys provide powerful insights into customer loyalty and brand perception. However, missteps in execution can lead to misleading data and missed opportunities for growth. By avoiding these 12 common mistakes, businesses can ensure their NPS surveys deliver meaningful, actionable insights that drive real improvements in customer experience. Instead of treating NPS as a standalone metric, companies should integrate it with other CX measures, act on feedback, and continuously refine their survey approach to keep pace with customer expectations.

Leave a Reply

Want to join the discussion?Feel free to contribute!