Maximizing ROI with Advanced Data Techniques in Family Offices

In the world of family offices, where managing wealth and investments is paramount, leveraging advanced data techniques can significantly enhance ROI (Return on Investment) and overall financial performance. Family offices, which handle the financial affairs of affluent families, are increasingly turning to sophisticated data analysis tools and strategies to optimize decision-making and achieve better outcomes. This article explores how these advanced data techniques are transforming family office operations and maximizing ROI.

Understanding the Role of Data in Family Offices

Family offices are responsible for managing a diverse range of assets, including investments in stocks, bonds, real estate, and private equity. Traditionally, decision-making in family offices relied heavily on experience, market knowledge, and personal relationships. However, the landscape is evolving rapidly with the advent of big data, artificial intelligence (AI), and machine learning (ML).

- Big Data in Family Offices

Big data refers to the vast amount of structured and unstructured data that is generated daily. Family offices can harness big data from various sources such as financial markets, economic indicators, social media, and even satellite imagery to gain valuable insights. By analyzing this data, family offices can identify emerging trends, predict market movements, and make informed investment decisions.

- Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) algorithms are revolutionizing how family offices analyze data. Incorporating a specialized family office database into their systems allows family offices to efficiently manage and analyze their wealth data, enhancing their capabilities to forecast financial outcomes with higher accuracy. These technologies can process large datasets at incredible speeds, uncover patterns, and generate predictive models. For example, ML algorithms can analyze historical market data to predict future trends or identify potential risks in investment portfolios. AI-powered chatbots can provide personalized financial advice to clients based on their unique financial goals and risk profiles.

- Data Visualization and Analytics Tools

Data visualization tools such as Tableau, Power BI, and Qlik Sense enable family offices to present complex data in intuitive dashboards and reports. These tools allow investment managers to visualize portfolio performance, track key performance indicators (KPIs), and identify outliers or opportunities for optimization. By leveraging interactive charts and graphs, family offices can communicate insights effectively to stakeholders and facilitate data-driven decision-making.

Case Studies: Real-World Applications

- Risk Management and Portfolio Optimization: Using advanced data analytics, a family office identified correlations between macroeconomic indicators and asset prices. By analyzing historical data and applying predictive analytics, the office adjusted its investment strategy to mitigate risks during economic downturns while maximizing returns during bullish market cycles.

- Client Relationship Management: A family office implemented a CRM (Customer Relationship Management) system integrated with AI capabilities to analyze client preferences, investment histories, and communication patterns. This enabled the office to offer personalized investment advice, anticipate client needs, and enhance client satisfaction. As a result, client retention rates improved significantly, leading to increased assets under management (AUM).

- Operational Efficiency: By adopting data-driven approaches to operational management, such as robotic process automation (RPA) and predictive maintenance, a family office streamlined back-office operations. RPA automated repetitive tasks like data entry and reconciliation, freeing up staff to focus on strategic initiatives. Predictive maintenance algorithms optimized the office’s IT infrastructure and minimized downtime, ensuring uninterrupted service delivery to clients.

Challenges and Considerations

While advanced data techniques offer substantial benefits, family offices must navigate several challenges:

- Data Privacy and Security: Protecting sensitive client information and complying with regulatory requirements (e.g., GDPR, CCPA) is paramount.

- Talent Acquisition: Recruiting skilled data scientists, AI engineers, and analysts with domain expertise in finance and investment management can be challenging.

- Integration with Legacy Systems: Integrating new data technologies with existing IT infrastructure and legacy systems requires careful planning and implementation.

Future Trends in Data-Driven Family Offices

Looking ahead, the role of data in family offices is expected to evolve further:

- Predictive Analytics and AI: Advances in predictive analytics and AI will enable family offices to anticipate market trends, optimize investment strategies, and personalize client interactions in real-time.

- ESG (Environmental, Social, and Governance) Investing: Data analytics will play a crucial role in evaluating ESG factors and integrating sustainable investment practices into family office portfolios.

- Blockchain and Cryptocurrency: Family offices may explore blockchain technology and cryptocurrency investments, leveraging data analytics to assess risks and opportunities in this emerging asset class.

Conclusion

In conclusion, advanced data techniques are transforming family office operations by enhancing decision-making, optimizing portfolio performance, and improving client engagement. By embracing big data, AI, and analytics tools, family offices can navigate complex market dynamics, mitigate risks, and capitalize on opportunities to maximize ROI for their clients and stakeholders. As technology continues to evolve, the role of data-driven insights in shaping the future of family offices will only become more pronounced and indispensable.

In the world of retail, creating an appealing and engaging environment for customers is crucial. One innovative tool that has gained popularity is SEG fabric. SEG stands for Silicone Edge Graphics, which refers to a type of fabric graphic that is used with a framing system.

In the world of retail, creating an appealing and engaging environment for customers is crucial. One innovative tool that has gained popularity is SEG fabric. SEG stands for Silicone Edge Graphics, which refers to a type of fabric graphic that is used with a framing system.

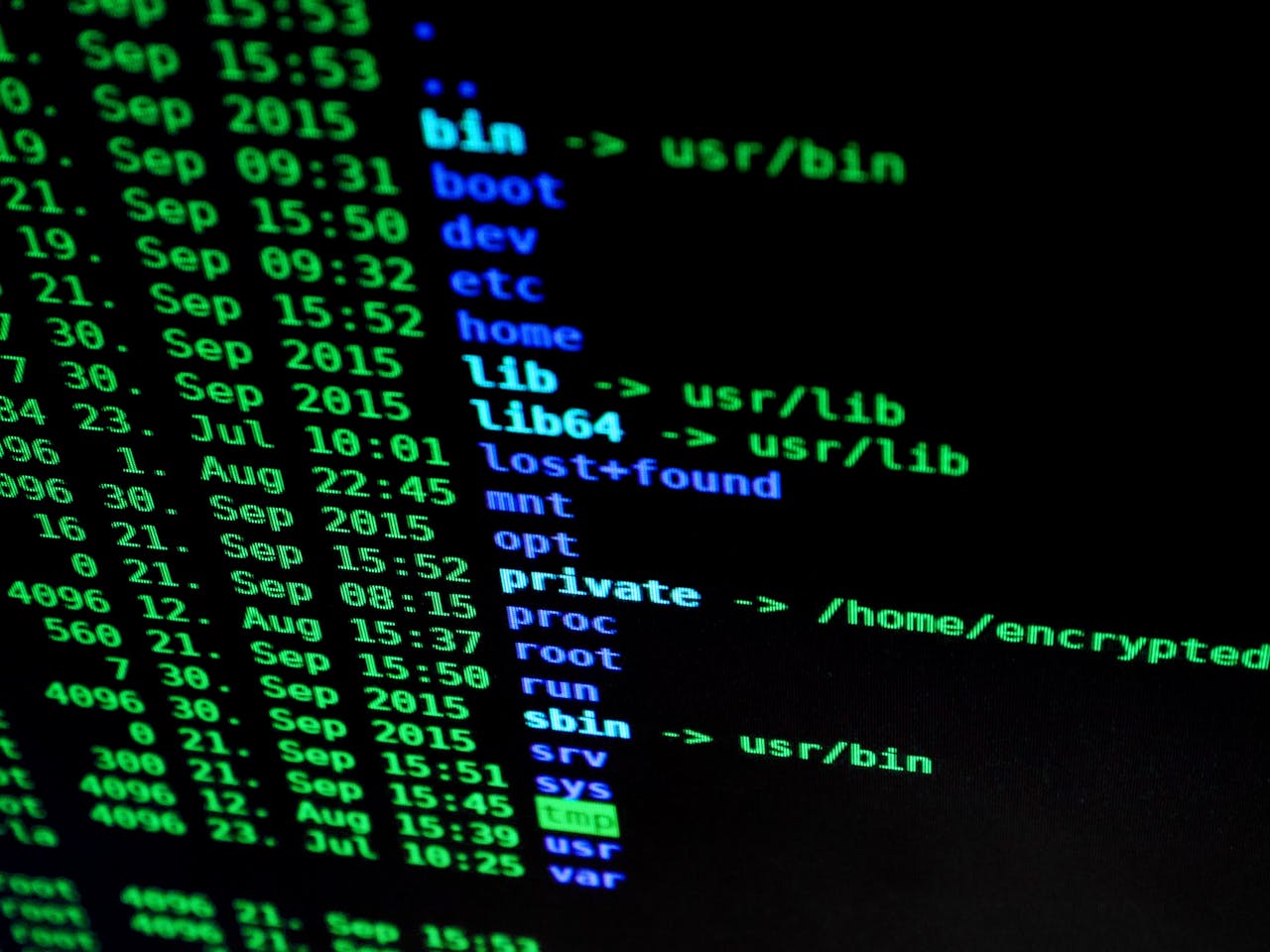

In today’s digital age, where everything from our personal information to critical infrastructure relies on technology, cybersecurity has become more crucial than ever. Companies, governments, and individuals alike face constant threats from cyberattacks that can disrupt operations, steal sensitive data, or cause financial losses. Detecting and preventing these attacks has thus become a top priority for cybersecurity professionals.

In today’s digital age, where everything from our personal information to critical infrastructure relies on technology, cybersecurity has become more crucial than ever. Companies, governments, and individuals alike face constant threats from cyberattacks that can disrupt operations, steal sensitive data, or cause financial losses. Detecting and preventing these attacks has thus become a top priority for cybersecurity professionals.