Best Emergency Loans for Bad Credit

Life can be unpredictable, and sometimes unexpected financial needs arise. Whether it’s a car repair, medical expense, or other emergency, having bad credit can make it difficult to get a loan from traditional lenders. Fortunately, options are available for those with bad credit who need access to emergency funds. This blog post will explore some of the best emergency loans for bad credit.

Personal Loans

Personal loans are unsecured loans that can be used for various purposes, such as debt consolidation, home improvements, or unexpected expenses. Unlike secured loans, personal loans do not require collateral, which means you don’t have to put up your home or car as security.

Personal loans are usually available from banks, credit unions, and online lenders. The amount you can borrow and the interest rate you’ll be charged will depend on factors such as your credit score and income. The repayment terms for personal loans can vary, but most lenders offer terms of one to five years. Interest rates can also vary widely, so it’s important to shop around and compare offers from multiple lenders before choosing a loan.

Payday Loans

Payday loans are short-term loans that are typically due on your next payday. They are often used by individuals who need cash quickly and have no other options for borrowing. The application process for payday loans to firms such as My Canada Payday is usually quick and easy, and you can often receive the funds on the same day you apply.However, payday loans come with very high-interest rates and fees, making them a very expensive form of borrowing. Sometimes, the interest rates can be as high as 400% or more. If you borrow $500, you could owe $600 or more when the loan is due. Payday loans can also lead to a cycle of debt. If you can’t repay the loan on your next payday, you may be tempted to roll the loan over, which means you’ll pay additional fees and interest.

Peer-to-Peer Loans

This type of lending allows individuals to lend money to others or small businesses without involving banks or other traditional financial institutions. Since P2P platforms assess both the borrower’s creditworthiness and the lender’s risk tolerance, they can be a good option for those with bad credit. Many lenders are willing to take on higher-risk borrowers if they provide reliable information about their financial situation so the lender can make an informed decision.

Secured Loans

Secured loans are a type of borrowing where the borrower provides collateral as security for the loan. This collateral can be an asset such as a house, car, or savings account. The lender, in turn, will hold a lien on the collateral until the loan is fully paid off.

Lenders consider secured loans less risky as they are assured of recovering their losses in case of borrower’s default. Due to this security, lenders offer lower interest rates and longer repayment terms, making secured loans more suitable for larger mortgages or car loans. However, for borrowers, secured loans risk losing the collateral if they cannot pay. This can result in the loss of a valuable asset and damage to their credit score.

When looking for emergency funds with bad credit, it’s crucial to carefully examine the terms and conditions of all available loan types before making a decision. Each option has advantages and disadvantages, so conduct thorough research and make a wise choice.

Handling Manpower

Handling Manpower Setting Realistic Expectations and Priorities

Setting Realistic Expectations and Priorities In today’s fast-paced and competitive business landscape, grasping your customers’ needs and preferences is essential for success.

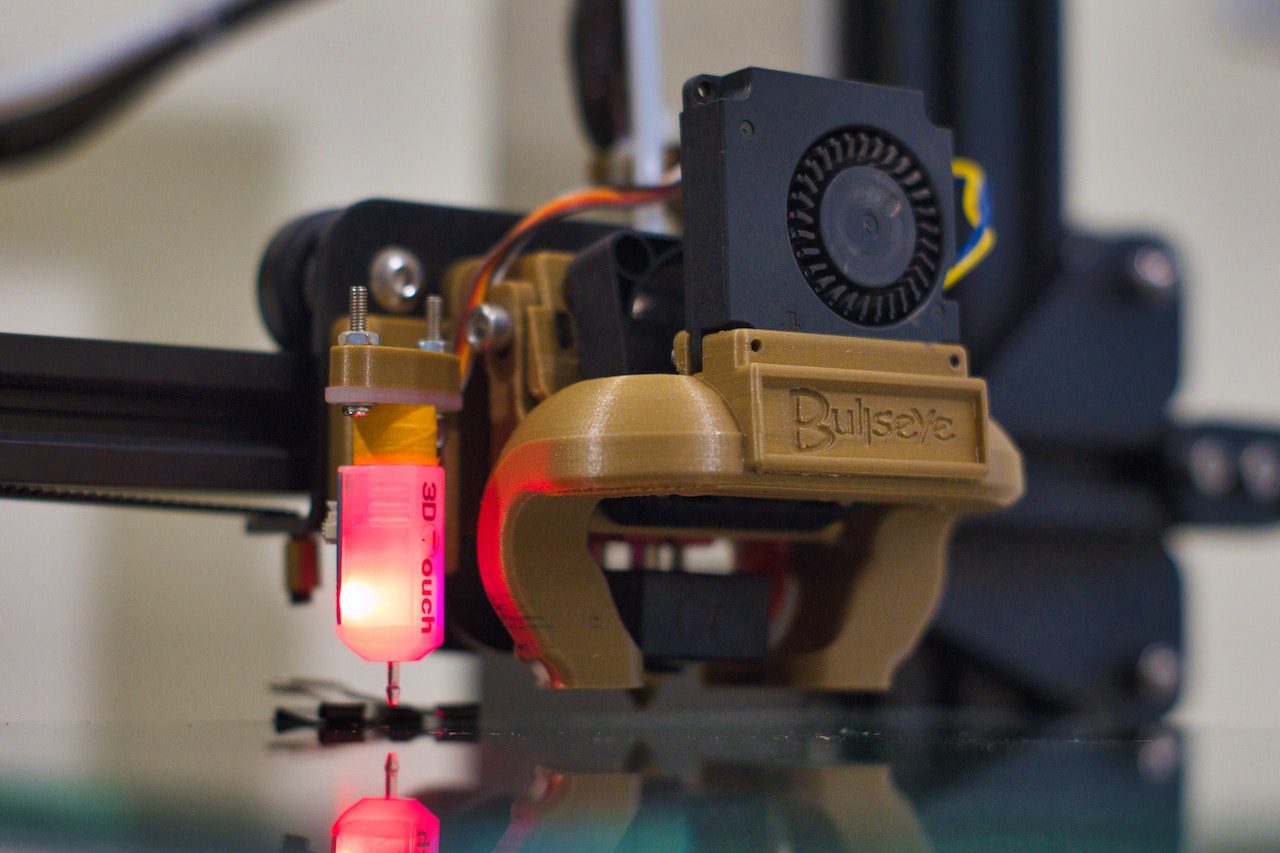

In today’s fast-paced and competitive business landscape, grasping your customers’ needs and preferences is essential for success. Whether 3D printing is your primary occupation or an occasional hobby, you can benefit from having a filament extruder on hand. For starters, it can reduce your time waiting for your online orders to arrive.

Whether 3D printing is your primary occupation or an occasional hobby, you can benefit from having a filament extruder on hand. For starters, it can reduce your time waiting for your online orders to arrive.