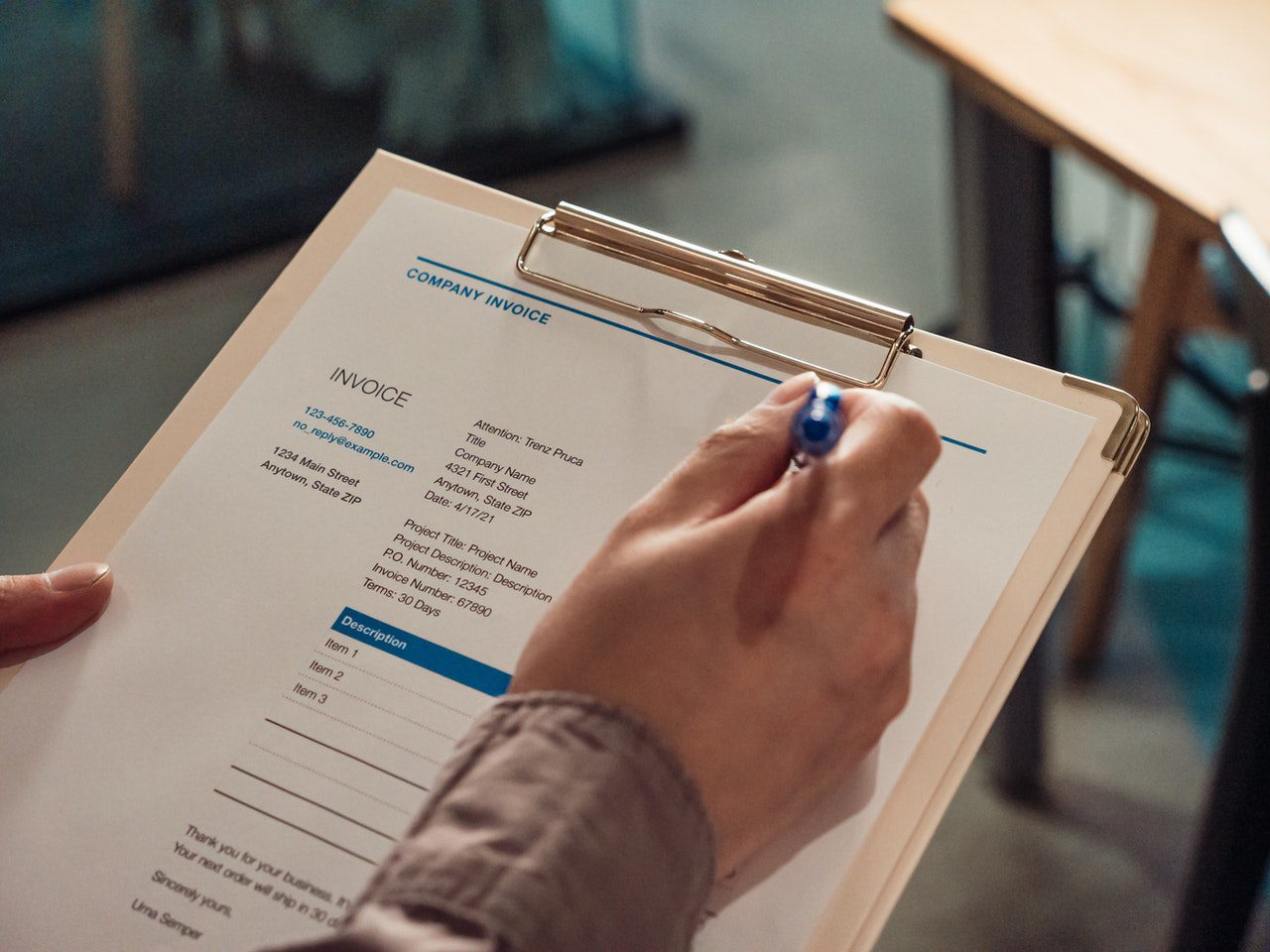

5 Ways Invoice Factoring Can Offer Quick Financial Solutions to Your Business

Offers Financial Flexibility

It is prudent for your business to maintain flexibility in cash flow. Your business needs to fund its operations and sustain its workforce despite hard economic times. Invoice factoring financing becomes vital as it offers your business the flexibility it deserves. You can use the unpaid invoices to get the funds you need at any time. You, however, need to find and work with a reputable factoring company to enjoy the flexibility. Remember, invoice factoring makes cash available to your business and helps avoid financial struggles that might affect its operations in the end.

Helps You Save Time and Resources

Note that applying for a bank loan means waiting for days before getting approval. The approval chances are also minimal, and your business can get affected as you wait for the approval. Most banks and credit unions also dictate that you provide collateral to process the loan. This, in the end, can be inconvenient, especially to a struggling business. However, using your unpaid invoices to secure funds saves time and resources. You avoid worrying about collateral and wasting during the application process.

Easy Application Process With Higher Financial Approval

Financial history, credit score, and collateral determine your chances of getting a loan approved by the bank. You must meet the criteria and the requirements for your business to get the funds it needs. This is, however, different when you consider invoice factoring. You don’t need to worry about collateral or your financial history to get approval. You only need to show your financial history to the customers. The factoring company needs to be confident about the payment history before taking your unpaid invoices.

Credit Control

Collecting your payments and managing the credit can have different impacts on your business. You need to be effective with debt collection to keep your cash flow steady. It is, however, hard when you have to deal with sneaky customers. You get quick financial solutions by considering invoice factoring as you avoid the stress of dealing with your customers. Note that the factoring company you sell your invoices to handles the payment collection process and credit control. You get more time and space to manage your business.

You Use the Funds for Any Business Purpose

Unlike other forms of loans, invoice factoring provides you with the funds to use for any business needs. There are no restrictions or conditions on where and how to use the funds. You can improve your working capital, fund expansion, purchase new stock and equipment and add more staff with the funds you get through invoice factoring. You enjoy financial freedom by working with a reputable factoring company.

It is crucial for a business to maintain its cash flow for its operations. However, it can prove hectic when you lack a proper financing avenue. As much as applying for loans can prove beneficial, the process can be overwhelming. You need invoice factoring to get quick financial solutions and enjoy other benefits, as highlighted above.

Leave a Reply

Want to join the discussion?Feel free to contribute!