Geting to Grips With Your New Business’s Finances

Starting a new business can be challenging, especially if you don’t have any financial training or experience. Your company will grow with wise financial choices and decisions, and there’ll be little room for error, especially in the first tentative months. However, this does not mean that you can’t do a little research and ensure that you seek the right advice so that your startup can begin to thrive, and you’ll become financially savvy as you evolve with your company. Therefore, it’s worth taking some time and making an effort to better understand your income and expenses. You’ll also need to work on where you’re you’re going to invest, save, and improve regarding your cash flow.

The more knowledge and understanding you possess surrounding your business finances, the more clarity you’ll have when it comes to important decision making and spending. It can be a challenge to gain the interest of other investors and those who will help you to take your business to the next level, especially when you’re a small fish in a big pond. Therefore, you must get the basics right regarding your money so that your success and reputation can proceed you in a meeting or networking event. The following are some ideas, inspiration, and advice for those who need a confidence boost regarding their business and its finances.

Get Yourself A Great Rating

When you’re trying to be careful with your funds, and save wherever you can; you might think that getting yourself a credit card might be a bad idea. However, it’s worth getting one so that you’ll have a credit rating or score for you and your business. Without a credit score, it can be difficult to gain investment or receive a loan, and you’ll probably need these at some point to invest further in your company. Take a look at the discover it review so that you can better understand how a credit card could work in the favor of your business. Alongside having a great credit rating; you’ll be able to receive rewards and even cash back on certain things when you use the card to spend, so it’s well worth looking into. As long as you’re prepared and able to pay your monthly bills back on time; there’s no reason a credit card and its resulting score, won’t be beneficial to your company.

Get Yourself Some Professional Advice

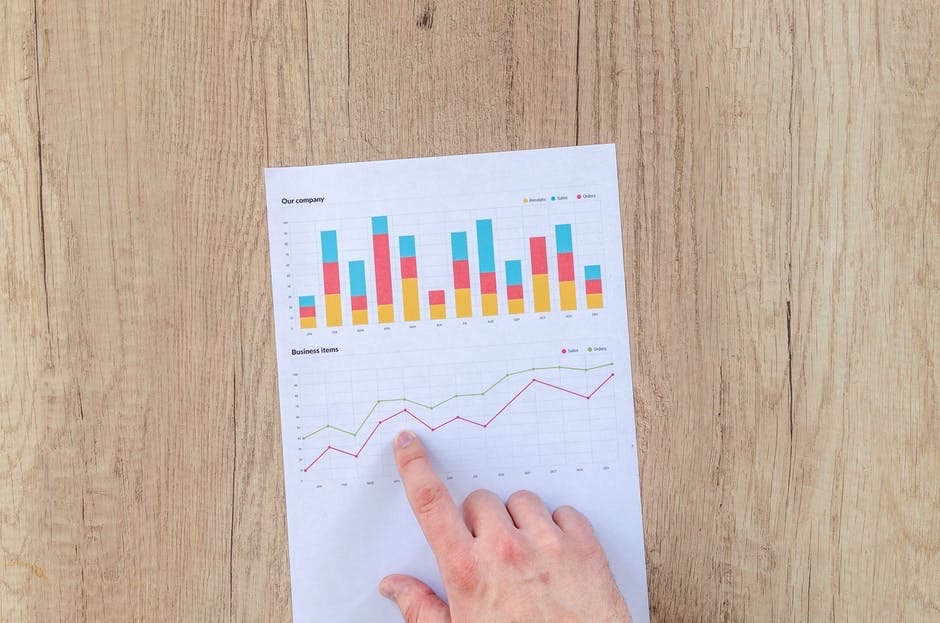

In order to ensure that you’re making the right choices regarding your money; you’ll to invest in expert help and advice. Hiring a reputable and qualified accountant to look over your finances, and advise you on what to do with your spending and saving, will give you the peace of mind that you’re making the right decisions for your business. They will be able to help you understand your monthly figures and targets, and they can suggest budgeting tools for when they’re not there; investing early on in expert advice will make sure that you reap the rewards further down the line.

Being an employer can be a tough job for a lot of people. In this sort of role, it can be very easy to be overly compassionate, giving people much more than you can afford. Likewise, though, some people are much too strict to be a good boss. Sat in between these two issues is a balance which few manage to reach. To help you out with this, this post will be exploring some subtle ways to watch over your workers, while also looking for ways to make their work easier. This may involve a little bit of spying, but this will be worth it if you’re able to make a difference.

Being an employer can be a tough job for a lot of people. In this sort of role, it can be very easy to be overly compassionate, giving people much more than you can afford. Likewise, though, some people are much too strict to be a good boss. Sat in between these two issues is a balance which few manage to reach. To help you out with this, this post will be exploring some subtle ways to watch over your workers, while also looking for ways to make their work easier. This may involve a little bit of spying, but this will be worth it if you’re able to make a difference.

News travels fast, and is easily shared thanks to the increasing role of social media in the lives of consumers and the businesses they engage with. Indeed, there are many advantages to this connectivity beyond the social aspect; people can instantly mark themselves ‘safe’ after natural disasters or violent attacks, and ‘good news’ stories from around the world inspire on a daily basis.

News travels fast, and is easily shared thanks to the increasing role of social media in the lives of consumers and the businesses they engage with. Indeed, there are many advantages to this connectivity beyond the social aspect; people can instantly mark themselves ‘safe’ after natural disasters or violent attacks, and ‘good news’ stories from around the world inspire on a daily basis.